Do I need an attorney to apply for Medicaid?

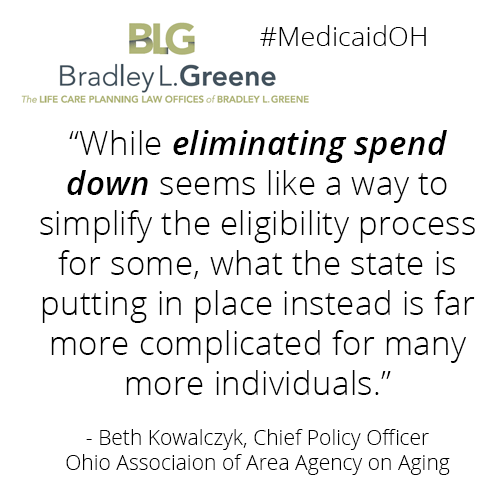

Medicaid laws are complicated and with upcoming administrative changes in the state of Ohio – the application process is likely to become even more complex and time consuming in the months following these transitions. Below is a list of five common scenarios in which we often provide support and guidance to our clients.

- Real Estate: Not everyone needs to sell their house in order to apply for Medicaid. A community spouse or other qualified family members may be able to remain in your home – there are very specific rules and scenarios around this asset determination.

- Married Couples: Often, one spouse requires nursing home care while their loved one stays in their home or apartment. Our guidance can help ensure that assets are divided properly and that the needs of both spouses are met, while the community spouse has as much financial security as possible.

- Asset Protection: Very few people qualify immediately for nursing home Medicaid coverage. Most middle-class individuals who need long term care will have to spend down some assets in order to qualify. Medicaid law allows for certain “exempt” assets that do not have to be included in this spend-down. An attorney can help you make informed decisions about how to spend resources and while keeping the best interest of your family in mind.

- Transfer of Assets: Medicaid looks back and reviews any transfer of funds in the five year period prior to application. Planning ahead can ensure that any transfers are proper and allowable – so that future Medicaid applications are not impacted by periods of ineligibility. There are a number of strategies for doing this, but laws are complex and differ in each state. Consulting a legal advisor who is well-versed in the Medicaid laws for your state can ensure that your decision now don’t impact your future security.

- Business Ownership: Current or past business relationships, including partnerships, shareholdings and business investments have to be fully disclosed during Medicaid application. This can complicate and delay the application process. A qualified elder law attorney can guide you through the process of reviewing state records and asset valuation to ensure that all legal requirements are met prior to application.

Bradley L. Greene, Esq. is a Life Care Planning and Elder Law firm located in Beachwood, OH specializing in Estate Planning, Medicaid Planning and Elder Abuse – offering personalized support and family guidance through all of life’s transitions.